Reimbursement gas mileage calculation

Now to calculate the mileage deduction. Your mileage reimbursement would be 12208 224 X 585 cents 13104.

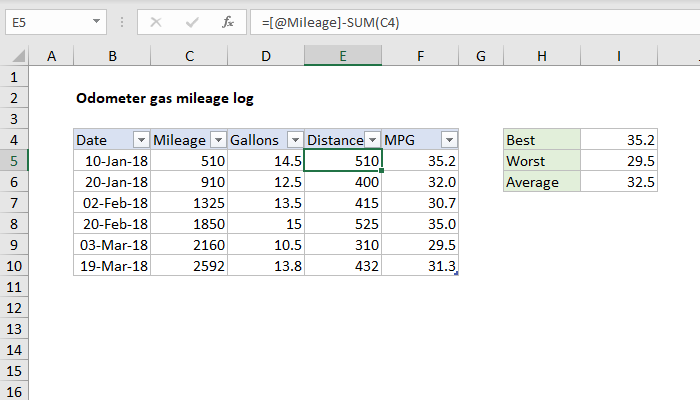

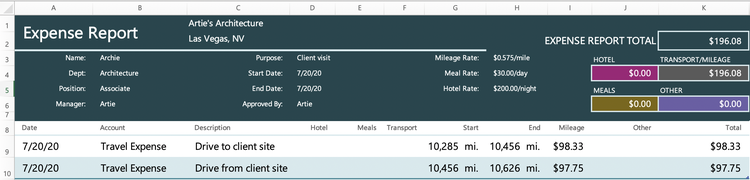

Excel Formula Odometer Gas Mileage Log Exceljet

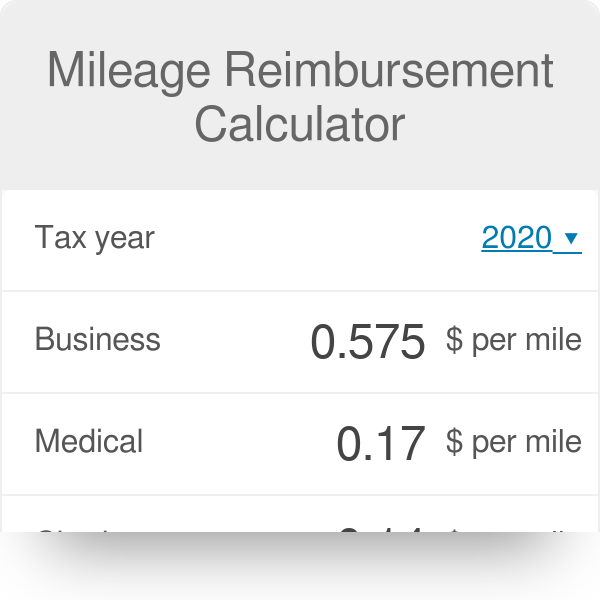

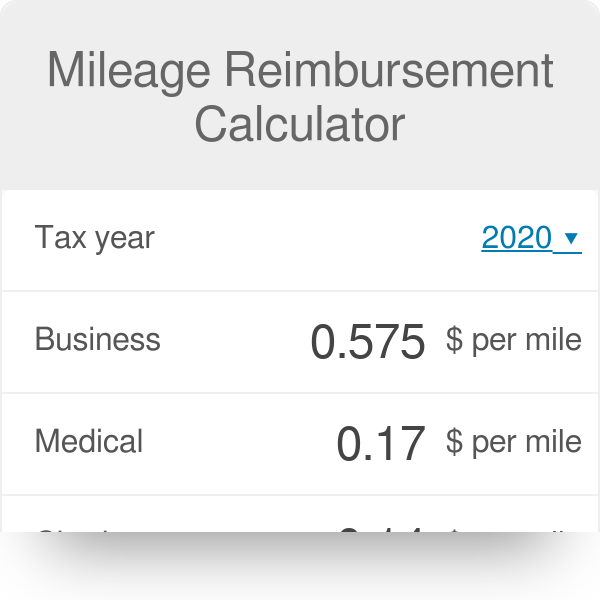

Accordingly the 2020 IRS standard mileage rates are.

. Select your tax year. Step 1 Select your tax year. Use a Mileage Rate Calculator.

To find your reimbursement you multiply the. Get total trip cost and mileage breakdown - mileage rate tracking mileage report gas tolls etc. Step 3 Optionally enter your miles driven for moving.

Keep in mind that this. To find your reimbursement you multiply the number of miles by the rate. Enter the estimated MPG for the vehicle being driven.

Your business mileage use was 20. The new rate for. Reimbursement amount miles rate 11700 200 miles 585 cents.

Step 2 Enter your miles driven for business purposes. Download MileIQ to start tracking your drives. Using a mileage rate The standard mileage rate is 56 cents per mile.

575 cents per mile for business miles 58 cents in 2019 17. The mileage reimbursement calculator is a helpful tool that allows to calculate a business deduction for Federal income tax purposes. If use of privately owned automobile is authorized or if no Government-furnished automobile is available.

You can calculate mileage reimbursement in three simple steps. For the final 6. Enter the current mileage reimbursement rate.

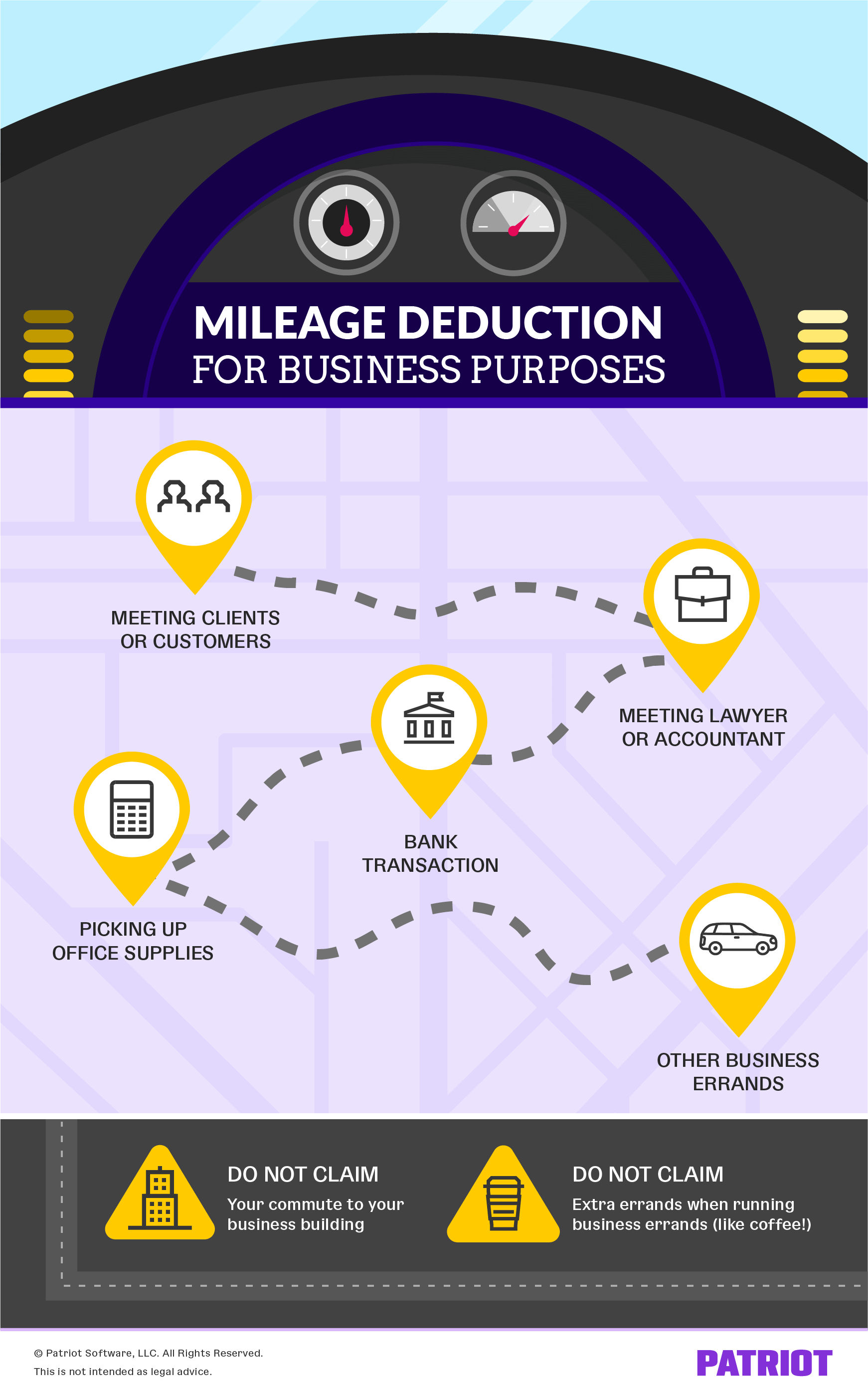

Enter applicable statelocal sales taxes and any additional feessurcharges. Taxpayers may use the optional standard mileage rates to calculate the deductible costs of operating an automobile for business and certain other purposes. If youre driving a lot for work you may need a handy mileage calculator tool for your reimbursable miles.

Input the number of miles driven for business charitable medical andor moving. Mileage Reimbursement Calculator instructions. 575 cents per business mile 17 cents per mile for medical or.

For example if the standard reimbursement vehicle gets 225 mpg and the gas prices are 550gallon we calculate the gas rate to be 2444mile. These tools make it easy to. As for Q1 Q2 of 2022 this rate is 585 cents per mile you drive while between July 1 and December 31 2022 the federal business mileage rate is 625 cents per mile the.

The same principles apply if you are self-employed. Each year the IRS sets the rate each mile driven for work is worth. Multiply the standard mileage rates and miles.

The question of how to calculate mileage reimbursement isnt as simple as x cents per mile should cover the price of gas Getting mileage reimbursement wrong not only. Miles rate or 175 miles. Try Mileage Reimbursement Calculator.

Gas mileage reimbursement rate for 2020 For this year the mileage rate in 2 categories have gone down from previous years. How do you calculate gas mileage reimbursement. July 1 2022.

To calculate your business share you would divide 100 by 500. 8 miles 585 cents 3 miles 18 cents 14 cents 5 miles 600 Your estimated mileage deduction is 600. The current standard mileage rate is 585 cents per mile.

Below is a simple reimbursement calculation using the standard IRS mileage rate. 15 rows Find optional standard mileage rates to calculate the deductible cost of operating a vehicle for business charitable medical or moving expense purposes. Use latest IRS reimbursement rate for work medical.

Deductible Mileage Rate For Business Driving Increases For 2022 Sol Schwartz

How To Calculate Your Mileage For Reimbursement Triplog

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

Company Mileage How Are Mileage Rates Determined

Mileage Calculator Credit Karma

Irs Sets Lower 2021 Standard Mileage Rates Njbia

Free Mileage Log Template For Excel Everlance

Employee Mileage Reimbursement A Guide To Rules And Rates

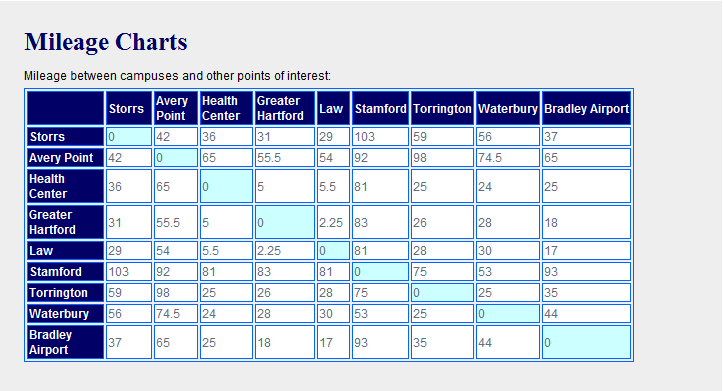

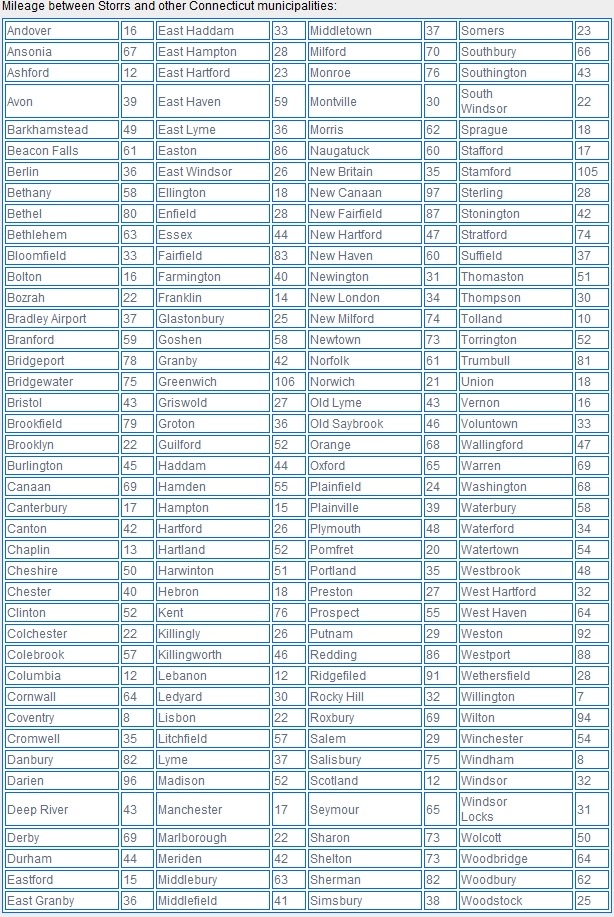

Mileage Calculation Accounts Payable

How To Calculate Mileage Reimbursement Guide To Deductions

Mileage Log Template Free Excel Pdf Versions Irs Compliant

Irs Boosts Standard Mileage Rates For The Rest Of 2022 South Carolina Umc

Mileage Calculation Accounts Payable

Mileage Reimbursement Rates What You Need To Know Tax Alert June 2021 Deloitte New Zealand

2021 Mileage Reimbursement Calculator

Mileage Reimbursement Calculator

How To Calculate Mileage Reimbursement Guide To Deductions